On Portland’s Bike Tax & Pittman-Robertson (But for Bicycling)

“Take a deep breath and consider this: Oregon is now the only state in America with a bicycle excise tax.”

-Jonathan Maus, editor of Bike Portland

“Good”

– Patrick Valandra, Pres. Tempe Bicycle Action Group

Photo Credit: http://www.billbonebikelaw.com

There’s been biblical levels of fear mongering coming out of the Pacific Northwest and cycling commentators following the recent vote by the City of Portland to impose a flat tax on new bicycle purchases. Arguments range from “the poor can’t afford it” to ‘the tax is so small that it won’t pay for anything. Mr. Maus even opined that the bill was “opposed by small business owners, advocacy groups, and by many voters.”

After traveling spending the better part of Summer 2016 in Portland, watching my pal Tall Todd plug in Biketown, attending my professional conference, crushing BUCPDX along with riding around with the fine folks in Portland I can honestly say this:

THEY ARE ABSOLUTELY CORRECT

- Taxes affect everyone, with the poor seeing a greater ratio of their salary affected by taxes.

- The annual tax is expected to generate about $1.2 million USD. This won’t pay for much using today’s NACTO design standards.

- Many business owners, advocacy groups and voters are against this bill (now Law).

ALSO: THEY ARE ABSOLUTELY WRONG (and should be ashamed for missing this opportunity)

Now, before you all run me out of town with your Italian brazed pitchforks, let me explain why I think that local groups such as Bike Portland and TBAG as well as national groups like the League of American Bicyclists and the National Bicycle Dealers Association should be spending every minute of their time lobbying local governments and Congress to pass a Pittman-Robertson (PR) type bill focused on bicycling. As an aside, the outdoor industry in general should be lobbying for such a bill but that is another post)

What is this fool talking about you may ask. As I explain Pittman-Robertson (PR), let’s hop in the wayback machine to a period between late 1800’s and early 1930’s:

Many wildlife species faced extinction due to overhunting (both commercial and private) and habitat destruction. Many states didn’t allow hunting, there were almost no conservation efforts and outdoor activities were extremely limited. People saw these issues as a threat to future hunting and recreational opportunities and rightfully so. In 1937, Senators Pittman (NV) and Robertson (VA) wrote and passed a bill to move an existing 11% excise tax on firearms and ammunition from the general treasury to the Dept. of the Interior. (This has been expanded to other hunting items but you get the idea; also if you feel tempted to post pro or con 2A arguments here; don’t – we’re a damn bike blog)

Now, instead of taking this money and putting it directly in the Treasury; PR created a separate account under the Department of the Interior. How is this money allocated..? well Wikipedia is actually helpfull here:

The Secretary (of the Interior) determines how much to give to each state based on a formula that takes into account both the area of the state and its number of licensed hunters.

States must fulfill certain requirements to use the money apportioned to them. None of the money from their hunting license sales may be used by anyone other than the states’s fish and game department. Plans for what to do with the money must be submitted to and approved by the Secretary of the Interior. Acceptable options include research, surveys, management of wildlife and/or habitat, and acquisition or lease of land. Once a plan has been approved, the state must pay the full cost and is later reimbursed for up to 75% of that cost through PR funds. The 25% of the cost that the state must pay generally comes from its hunting license sales. If, for whatever reason, any of the federal money does not get spent, after two years that money is then reallocated to the Migratory Bird Conservation Act.

Now if you mind works like mine – you can see how this plays out for cyclists if such a “Cyclists Pittman-Robertson” (C-PR) bill were passed – (edits are mine)

The Secretary (of Transportation) determines how much to give to each state based on a formula that takes into account both the area of the state and its number of cyclists.

States must fulfill certain requirements to use the money apportioned to them. None of the money from their cycling accessory sales may be used by anyone other than the state’s Transportation department (and only for cycling related projects). Plans for what to do with the money must be submitted to and approved by the Secretary of Transportation. Acceptable options include research, surveys, management of cycling infrastructure, and acquisition or lease of land for said infrastructure. Once a plan has been approved, the state must pay the full cost and is later reimbursed for up to 75% of that cost through C-PR funds. The 25% of the cost that the state must pay generally comes from its cycling accessory sales. If, for whatever reason, any of the federal money does not get spent, after two years that money is then reallocated to non-profits focused on cycling and used for training, education or tourism (etc)

Sounds good right!

What happened with wildlife as a result of Pittman-Robertson? I like pictures so let’s look at the growth of hunting opportunity

From: http://www.fishwildlife.org/files/WildlifeRestoration-ROI-Report_2011.pdf, p33

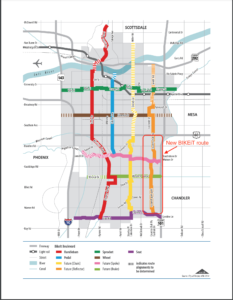

The photo shows an increase in hunting days since 1930. As a hunter, I know you can’t hunt what isn’t there. PR Conservation dollars paid to improve habitat and, thus hunting opportunity. For example, In 1937, Missouri’s deer season was only three days long, and harvested 108 deer. Today hunters in Missouri can hunt deer for 123 days (a 4000% increase) During 2009, Missouri hunters took almost 300,000 deer. As a cyclist, I can imagine how a paltry (by comparison) 200% increase in cycling infrastructure would improve the cycling network and opportunity here in Tempe.

Many may say, that will never work for cycling, we already pay taxes and our mode of transport is less hard on roadways (maintenance). I’d say you are full of it because you don’t understand perception: Drivers believe that, in general, their tax money should benefit them, because they pay a tax and establish the funding. The result is that little money is spent on things that do not improve motoring opportunities.

How do cyclists counter this perception that they don’t pay – you got it! By establishing a dedicated tax to pay for their infrastructure and immediately and forever dispel the myth that cyclists are freeloaders. I thinking of purchasing a new bike soon – the bike I like will cost well over $2000. If I had to pay an extra $15 (a 0.0075% tax on $2K) – knowing that this money went to pay for improvements around cycling opportunities – I’d be ecstatic. I’d buy a $200 dollar helmet knowing that 11% of that purchase ($22) would stay local to pay for bike lanes and the like. Shoot! I’d buy local knowing that my new tires fund the bike lane I am riding on. And guess what, I’d also be 100% demanding that money to be used for what it was intended. Instead of fighting for transportation dollar scraps, I’d have the most powerful argument available: “because I paid for it out of my taxes”. And here’s the beautiful twist; unlike auto users, cyclists could point to a specific tax, singled out to pay for the stuff we want. Drivers simply could not do this because fuel, license and registration fees account for, at most, 50% of the cost of building and maintaining roads.

I’ve long thought that the cycling industry should employ the strategies and tactics that the hunting and firearm industries use. This is a simple persuasion play using their exact tactics – we pay for our own stuff and thus we deserve it. This is so powerful that it cannot be outflanked and there is no city department or politician who can say you don’t get use your ear marked tax dollars. It was so successfully in the hunting industry that, 13 years after it was passed, a similar law was passed to benefit fishing and the fishing industry begged for it to pass!

The cycling industry can lead the way here. However, it will take a leadership change along with advocates who understand that most of the arguments against cycling are based on perception. Instituting a C-PR type bill would immediately swing the tide in transportation funding and wipe out the largest perception: Cyclists don’t pay their way.

The recent tax on bikes in Portland has immediately put the cycling community on the same plane as motorists. Some say the the tax was instituted as a punitive measure by non-cyclist groups intended to punish cyclists – even it it is, it was a grave tactical error. We’ll soon see whether the business owners and advocates in PDX embrace their new found power or continue to look this gift horse in the mouth.

Up next: I’ll tell you why I believe cyclists should be licensed… (hint – because persuasion)

NB – While the author is the President of TBAG, these comments are his own and not of TBAG supporters or the TBAG Board of Directors.